Summary

SpaceKnow indices can be used to track US Building Permits, Housing Starts, and non-residential construction spending. Our indices recovered slightly in Q4 2022, suggesting that the outlook for the US construction industry is improving from weak conditions last year.

In more detail

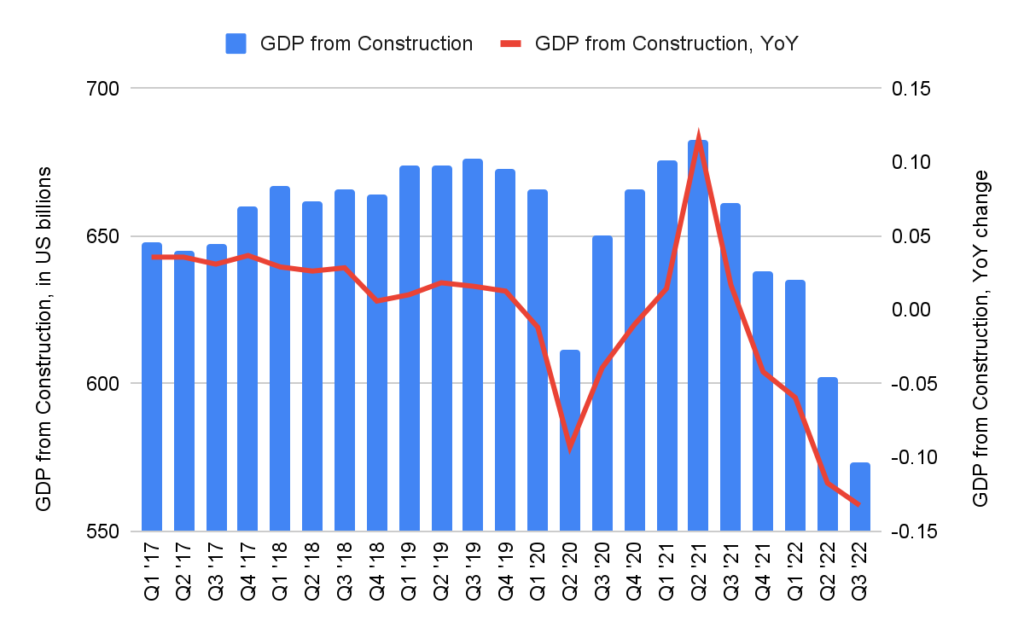

The construction sector in the US has been subdued since the beginning of the pandemic and its contribution to the real GDP has been declining steadily. Based on the United States of America Construction Industry Report 2022, the US construction sector has recently been shaped by a divergence between real and nominal values. The sector contracted in real terms in 2021 but grew 8.3% in nominal terms. In 2022, the construction industry was expected to expand, both in real and nominal terms due to the government’s investment plan. However, US Census data shows otherwise. Real GDP from construction and the contribution of construction to real GDP have been in free fall since 21Q2 (Figure1).

Source: St. Louis FED, FRED Economic Data, Trading Economics

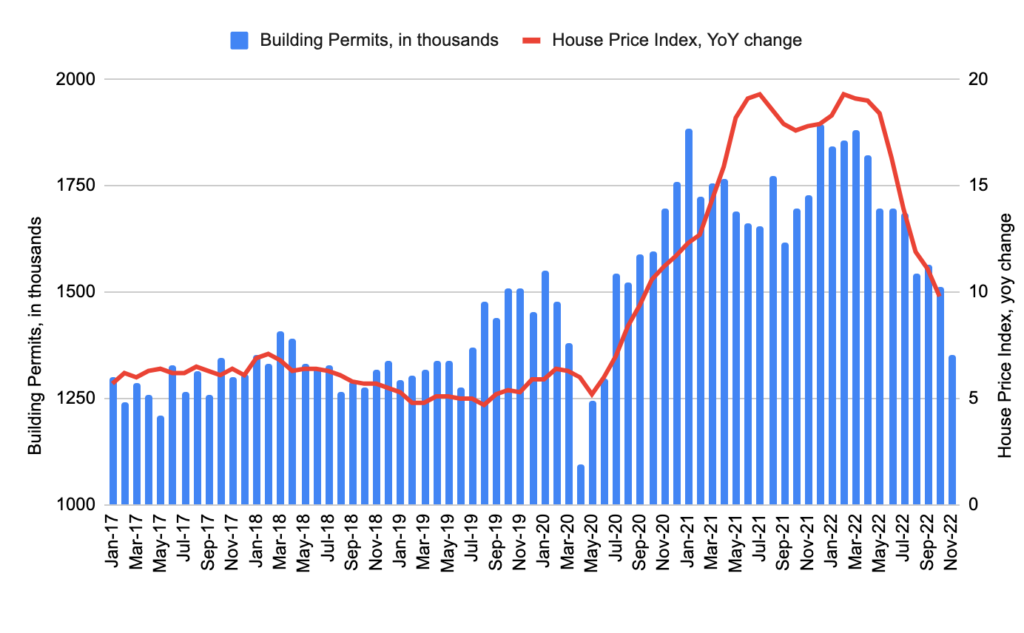

During the pandemic, US building permits soared as house prices rose, driven by increased demand and the drop in interest rates. However, both US building permits and the house price index have been declining since the end of the first quarter of 2022.

Source: Trading Economics

Demand for residential housing has been clearly impacted by the increase in mortgage rates. Affordability of home ownership declined as buyers lost purchasing power, driven by high inflation and mortgage rates. At the same time, construction costs increased because of supply chain disruptions and increasing energy costs worldwide. Rising costs became the biggest obstacle to completing projects for construction companies.

The non-residential construction industry looks more promising than the residential industry. The US infrastructure bill raised prospects for the future of non-residential construction. Infrastructure investments are designed to support several high-profile projects which have already been planned or are under construction. Despite the decline in residential construction spending, total non-residential construction spending continued to grow in 2022.

Spaceknow has a family of indices monitoring the production and storage of materials used in the US construction industry. These data sets cover major building components such as cement, concrete, and asphalt but also intermediate inputs such as aggregates or sand. The data set also includes aggregate indices providing a comprehensive look at the industry and a regional breakdown of four US regions (MidWest, NorthEast, South, and West).

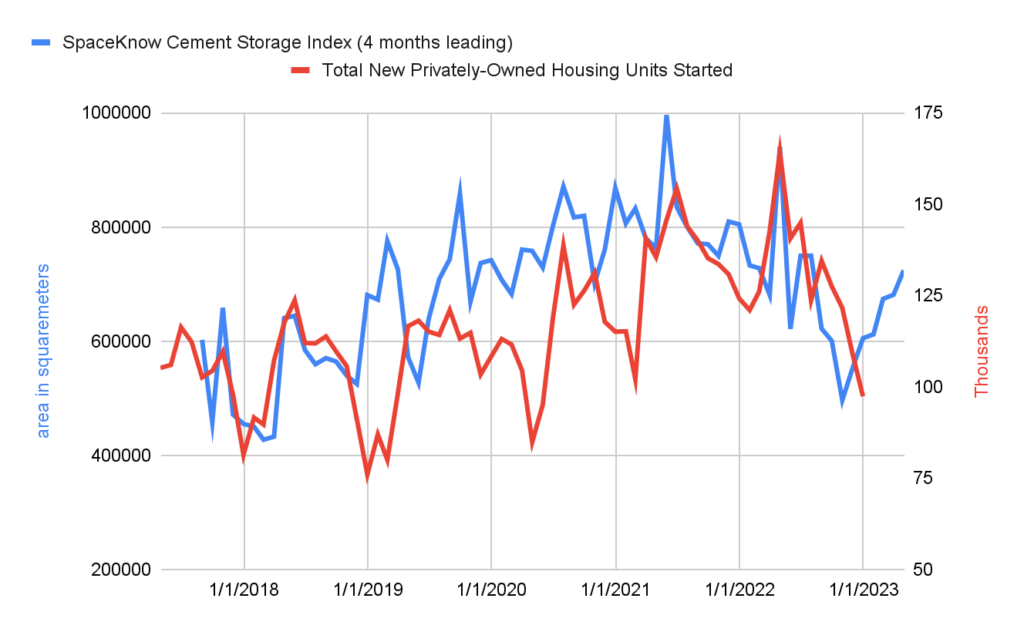

The indices presented below are based on satellite imagery, specifically Synthetic Aperture Radar (SAR) measurements. The result shows the area that has changed between consecutive satellite revisits and indicates a rate of change in total activity for a given location (Figure 3).

Source: SpaceKnow, St. Louis FRED Economic Data, U.S. Census Bureau

Our indices match the general trend of the construction industry in the US as visible in Figure 3 depicting the Cement Storage Index and US housing starts data (released monthly by US Census Bureau). The relationship between the SpaceKnow Cement Storage Index and US housing starts can also be used to illustrate key properties of Spaceknow indices. Figure 2 shows a non-seasonally adjusted version of the index. The index tracks the most significant peaks in construction activity. On the other hand, the index cannot match the specific seasonality of the US housing starts with its lowest point shortly after a new year begins. The reason for this is likely an inventory buildup in the construction industry in preparation for the building season causing higher activity in cement storage locations when building activity is subdued. Adjusting for seasonality will allow the user to appropriately use SpaceKnow indices to predict US Housing Starts data.

Another important property of the Spaceknow indices is that they predict activity in US construction a few months ahead. We can see in Figure 3 that most of the significant peaks in housing starts are matched by a similar increase in our cement storage index four months earlier – this suggests our index leads the changes in and can help to predict US building season.

We also compared our indices to other key indicators such as US building permits (released monthly by US Census Bureau). In contrast to the housing starts, our index seems to be the best predictor of building permits in real-time (Figure 4). This suggests the cement industry reacts to the orders for materials done shortly after a building permit is issued. The actual construction starts later, which explains the lag between our index and the housing starts. While our indices are updated daily, US building permits data is made available with a lag.

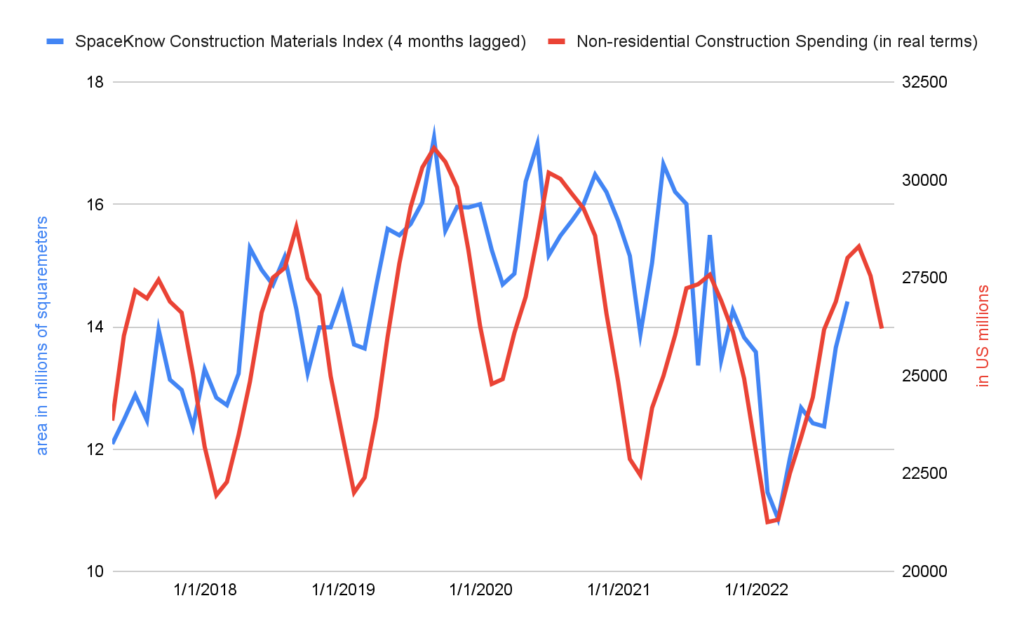

Last but not least, we tested our indices on financial variables. In this case, we work best with non-residential construction spending. Construction spending was driven by inflation in recent months, causing a split between nominal and real value. When we adjust the construction spending for inflation, we can see a solid match between our indices and the benchmark. We prefer our composite materials index which also contains materials such as concrete or asphalt. These materials justify the correlation with non-residual construction, as these are used primarily in large infrastructure projects.

A common feature shared among our indices is a significant decline in the value of the index in the first half of 2022, reaching its lowest point in the summer and then starting to recover. The year-on-year drop in the Spaceknow Cement Storage index was over 30 percent in July 2022 and remained in negative territory compared to the previous year. This is also confirmed for the seasonally adjusted indices and corresponds to widespread recession fears witnessed last year. Our indices, however, show a growing trajectory as soon as August 2022, and with certain seasonal ups and downs, they continue to increase. We believe this is a good sign for the US construction market.

Thank you for reading. Did you find this article interesting? Share it with a friend or colleague.

Client Support

Each client is assigned an account representative who will reach out periodically to make sure that the data packages are meeting your needs. Here are some other ways to contact SpaceKnow in case you have a specific question.

For delivery questions and issues:

Please reach out to support@spaceknow.com

For data questions:

Please reach out to info@spaceknow.com

For pricing/sales support:

Please reach out to info@spaceknow.com or sales@spaceknow.com

Disclaimer

This report is provided by SpaceKnow, Inc. (“SpaceKnow”) pursuant to the following terms and conditions:

Industry data and reports published by SpaceKnow (“SpaceKnow Reports”) and made available to paid subscribers and/or other recipients (collectively “Recipients”) are creative works of the mind achieved through algorithmic analysis of publicly available data and the information therein is proprietary to SpaceKnow and protected by copyright. Any copying, distribution or reproduction without the prior permission of SpaceKnow is strictly prohibited.

SpaceKnow Reports are confidential and nothing therein may be disclosed, reproduced, transmitted, distributed, sold, licensed, or altered, in whole or in part, without SpaceKnow’s prior written consent. SpaceKnow reserves the right to release to the public at any time the data and reports provided to Recipients. No rights in SpaceKnow Reports or any of the information contained therein are transferred to Recipients. Any misappropriation or misuse of the information in SpaceKnow Reports will cause serious damage to SpaceKnow and money damages may not constitute sufficient compensation to SpaceKnow; consequently, Recipients agree that in the event of any misappropriation or misuse, SpaceKnow shall have the right to obtain injunctive relief in addition to any other legal or financial remedies to which SpaceKnow may be entitled.

SpaceKnow Reports are based only upon its algorithmic analysis of publicly available data and do not use or rely upon any material non-public information (“MNPI”). The insights included in SpaceKnow Reports do not constitute MNPI or inside information and SpaceKnow is not an insider. SpaceKnow Reports (1) may contain opinions based on third party sources that are not independently verified for accuracy or completeness, (2) may contain forward- looking statements, which are identified by words such as “expects,” “anticipates,” “believes,” or “estimates,” and similar expressions, and (3) are current as of the date of publication but may contain information or statements that are subject to change without notice. SpaceKnow has no obligation to, and will not, update any information contained in SpaceKnow Reports. Actual outcomes could differ materially from those anticipated in SpaceKnow Reports. As a result, the use of SpaceKnow Reports is at Recipients’ own risk.

SpaceKnow and its owners, affiliates and representatives are not (1) investment advisers, commodity trading advisers, broker-dealers, financial analysts, financial planners, or banks, (2) compensated for providing investment advice, (3) registered or licensed with any regulatory body in any jurisdiction as investment advisers, commodity trading advisers, financial planners, broker-dealers, or in any other capacity (including, without limitation, the U.S. Securities & Exchange Commission (the “SEC”), the U.S. Commodity Futures Trading Commission (the “CFTC”), the U.S. Financial Regulatory Authority (“FINRA”), or their equivalents in non- U.S. jurisdictions), and do not recommend the sale or purchase of securities or commodity interests, or (4) licensed or able to provide investment advice or respond to individual requests for recommendations to purchase or sell any securities or commodity interests. No regulatory body in any jurisdiction (including the SEC, CFTC, FINRA, or a regulatory body of any state or any non-U.S. jurisdiction) has endorsed SpaceKnow or the contents of SpaceKnow Reports or the accuracy, adequacy, safety, reliability, usefulness, quality or legitimacy of any information provided to subscribers in SpaceKnowReports. SpaceKnow Reports are not intended to constitute investment advice. SpaceKnow is not an investment adviser within the meaning of Section 202(a)(11) of the U.S. Investment Advisers Act of 1940, as amended, and is not a commodity trading adviser within the meaning of Section 1(a)(12) of the U.S. Commodity Exchange Act. SpaceKnow does not provide investment advisory, portfolio management or financial planning services. The analyses, forecasts, metrics, samples, estimated figures, trends, figures, tables, graphs, projections and other forms of data that may be contained in SpaceKnow Reports do not represent or contain any recommendations to buy or sell any security or any financial products and should not be relied upon as the basis for any transactions in securities.

SpaceKnow Reports are for informational, promotional, educational or evaluation purposes only. Any information contained in SpaceKnow Reports constitutes the opinion or forward-looking statement of individuals and is provided without any representation or warranty of any kind. Neither SpaceKnow nor its directors, officers, employees, agents or representatives shall have any responsibility to you or any third party for the accuracy or completeness of any information provided in any SpaceKnow Report.

Should you have any questions, please contact us at SKNowcastingSolutions@spaceknow.com.