December 12, 2022

Summary: We join the discussion on this year’s record Black Friday using our family of CFI indices for 4000+ logistics centers in the US. Black Friday 2022 wasn’t only a result of increasing prices but a genuine increase in retail volume activity. We also used the indices to document changes in the US logistics sector – it adapted to the COVID experience by building more logistics centers and shifting towards a more gradual way of dealing with seasonal inventory.

This year’s Black Friday and Cyber Monday sales were very strong, after a few slow months for retail sales. The US is facing inflation not seen in decades, and a cost-of-living crisis is forcing people to cut their spending across continents – Europe was especially hit with a looming recession and a raging energy crisis. Nevertheless, the holiday season prediction for the US was cautiously optimistic, and the first data suggest this optimism was correct.

Consumers are not the only group under pressure this year.. Retailers’ planning was also greatly affected by the general economic volatility of the last 3 years, with covid lockdowns hugely disrupting supply chains and the war in Ukraine putting pressure on the energy sector and beyond. US retailers tried to learn from the troubles of the COVID pandemic and built up a significant stock of inventories. This resulted in the struggle to sell them this year – leading to special discounts.

This year’s Black Friday was a record in terms of sales in US dollars. Estimates of sales growth range from 5 percent to 12 annually, as indicated by credit card data. Nominal growth was strongly influenced by inflation, and these numbers cannot answer questions about volume/real growth. Some of the indicators however point to good performance beyond increasing prices. The National Retail Federation survey, for example, suggests that the physical number of shoppers was at a record high reaching 197 million.

Spaceknow observes logistic centers in the US with a family of Continuous Feed Indices (CFI) that allow us to follow the performance of the American retail sector in near real-time. We track activity in and around loading docks at these logistics/distribution centers using synthetic aperture radar images. Our indices enable us to approximate how many trucks were added and how many left a particular sample of depots between two satellite revisits. An important note here: by observing logistics centers, we monitor two things. One, the behavior of the retailer/distributor themselves as they accumulate inventory ahead of the Christmas season, and two, actual sales as customers shop online and in the retail stores, which leads to trucks leaving the distribution center to reach homes and/or stock retail shelves.

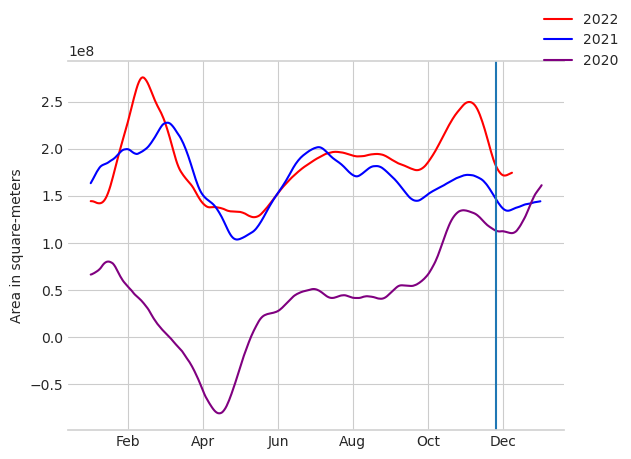

Figure 1 shows the development of the CFI-AL index, which is a cumulative sum of the changes in the logistic centers. Compared between years, the index can be interpreted as the total capacity of the US logistic centers. A rising index means positive changes prevail over negative over time, here as the result of new logistic centers being opened and becoming monitored by Spaceknow. Our ALI index is a solid measure of retail activity in the United States. It allows us to follow the trend of US retail activity even in the recent period of high inflation. Note that our benchmark is in USD, whereas the index, by design, corresponds to the physical movement of goods.

Figure 2 shows an expansion of the US logistic sector over the years. This expansion can be attributed to the rise of e-commerce and the sector’s reaction to the covid related disruptions. Moreover, the figure shows that the activity increases around November each year – in a clear inventory build-up for Black Friday and the Christmas shopping season. The steep peak of the red line in October-November suggests higher inventories this year than in 2021, indicating a powerful build-up.

Figure 3 shows the CFI-S index that uses the sum of changes over a fixed sample of locations and allows us to peek into the operations of a representative logistic center. We can see that the index behavior this year differs from the previous ones. We see that the characteristic uptick in total activity around the start of November in 2020-2021 was not followed in 2022. Instead, we see a steady increase. This development is in line with a shift towards a “ship early, ship often” strategy learned from the supply chain stress prevalent in the previous years by many companies. They also allow a much higher and more gradual inventory buildup than in the earlier years to ensure they can provide the customers with the goods they ask for. The result is a departure from the traditional freight peaks (visible in 2021 and 2020), extending much of Black Friday freight activity to earlier periods.

Figure 3 also shows that the CFI-S index is lower compared to previous years. This could suggest overcapacity in US logistics. While the sector as a whole shows a record performance, our index indicates that individual logistic centers are less busy than in previous years in terms of absolute truck movements.

What is the final SpaceKnow judgment about Black Friday and Christmas sales this year? To roughly estimate this year’s Black Friday sales, we can use year-on-year changes in our CFI-ALI index mentioned above. We sum up the last 30 days before Black Friday each year and compare. The results are visible in Figure 4. It shows the index is more than 20 percent higher in 2022 compared to 2021. As our index primarily measures the physical movement of goods, this suggests that the strong results were not just the result of inflation.

We joined the discussion on this year’s record Black Friday using our family of CFI indices for 4000+ logistics centers in the US. Comparing our indices in the last three years gave us an answer – Black Friday 2022 wasn’t only a result of increasing prices but a genuine increase in retail activity. Besides that, we used the indices to document the long-term changes in the US logistics – its adaptation to the COVID experience by a capacity build-up and shift towards a more gradual way of dealing with seasonal inventory.

SpaceKnow’s nowcasting products bring confidence and reduce risk to operations and investments around the world. Interested in learning more about SpaceKnow’s commercial and nowcasting products? Reach out to info@spaceknow.com

Did you enjoy this article? Subscribe using this link, and be the first to receive the next SpaceKnow Nowcasting Newsletter (SNN).

SpaceKnow provides satellite activity data. We research and monitor hundreds of thousands of locations, spanning different industries, to create the world’s most comprehensive activity datasets. Users can now gain a near-real-time, unbiased look at levels of activity for countries, companies, and commodities. Our customers include investors, traders, corporate strategists, economists, and governments.

Disclaimer

This report is provided by SpaceKnow, Inc. (“SpaceKnow”) pursuant to the following terms and conditions:

Industry data and reports published by SpaceKnow (“SpaceKnow Reports”) and made available to paid subscribers and/or other recipients (collectively “Recipients”) are creative works of the mind achieved through algorithmic analysis of publicly available data and the information therein is proprietary to SpaceKnow and protected by copyright. Any copying, distribution or reproduction without the prior permission of SpaceKnow is strictly prohibited.

SpaceKnow Reports are confidential and nothing therein may be disclosed, reproduced, transmitted, distributed, sold, licensed, or altered, in whole or in part, without SpaceKnow’s prior written consent. SpaceKnow reserves the right to release to the public at any time the data and reports provided to Recipients. No rights in SpaceKnow Reports or any of the information contained therein are transferred to Recipients. Any misappropriation or misuse of the information in SpaceKnow Reports will cause serious damage to SpaceKnow and money damages may not constitute sufficient compensation to SpaceKnow; consequently, Recipients agree that in the event of any misappropriation or misuse, SpaceKnow shall have the right to obtain injunctive relief in addition to any other legal or financial remedies to which SpaceKnow may be entitled.

SpaceKnow Reports are based only upon its algorithmic analysis of publicly available data and do not use or rely upon any material non-public information (“MNPI”). The insights included in SpaceKnow Reports do not constitute MNPI or inside information and SpaceKnow is not an insider. SpaceKnow Reports (1) may contain opinions based on third party sources that are not independently verified for accuracy or completeness, (2) may contain forward- looking statements, which are identified by words such as “expects,” “anticipates,” “believes,” or “estimates,” and similar expressions, and (3) are current as of the date of publication but may contain information or statements that are subject to change without notice. SpaceKnow has no obligation to, and will not, update any information contained in SpaceKnow Reports. Actual outcomes could differ materially from those anticipated in SpaceKnow Reports. As a result, the use of SpaceKnow Reports is at Recipients’ own risk.

SpaceKnow and its owners, affiliates and representatives are not (1) investment advisers, commodity trading advisers, broker-dealers, financial analysts, financial planners, or banks, (2) compensated for providing investment advice, (3) registered or licensed with any regulatory body in any jurisdiction as investment advisers, commodity trading advisers, financial planners, broker-dealers, or in any other capacity (including, without limitation, the U.S. Securities & Exchange Commission (the “SEC”), the U.S. Commodity Futures Trading Commission (the “CFTC”), the U.S. Financial Regulatory Authority (“FINRA”), or their equivalents in non- U.S. jurisdictions), and do not recommend the sale or purchase of securities or commodity interests, or (4) licensed or able to provide investment advice or respond to individual requests for recommendations to purchase or sell any securities or commodity interests. No regulatory body in any jurisdiction (including the SEC, CFTC, FINRA, or a regulatory body of any state or any non-U.S. jurisdiction) has endorsed SpaceKnow or the contents of SpaceKnow Reports or the accuracy, adequacy, safety, reliability, usefulness, quality or legitimacy of any information provided to subscribers in SpaceKnowReports. SpaceKnow Reports are not intended to constitute investment advice. SpaceKnow is not an investment adviser within the meaning of Section 202(a)(11) of the U.S. Investment Advisers Act of 1940, as amended, and is not a commodity trading adviser within the meaning of Section 1(a)(12) of the U.S. Commodity Exchange Act. SpaceKnow does not provide investment advisory, portfolio management or financial planning services. The analyses, forecasts, metrics, samples, estimated figures, trends, figures, tables, graphs, projections and other forms of data that may be contained in SpaceKnow Reports do not represent or contain any recommendations to buy or sell any security or any financial products and should not be relied upon as the basis for any transactions in securities.

SpaceKnow Reports are for informational, promotional, educational or evaluation purposes only. Any information contained in SpaceKnow Reports constitutes the opinion or forward-looking statement of individuals and is provided without any representation or warranty of any kind. Neither SpaceKnow nor its directors, officers, employees, agents or representatives shall have any responsibility to you or any third party for the accuracy or completeness of any information provided in any SpaceKnow Report.