Summary:

Spaceknow’s indices for Germany show a stumbling economy. These indices provide valuable insights and data for analyzing economic trends and performance, including manufacturing output, autos, services, retail sales, trade, new orders, and construction.

In More Detail:

After years of driving economic growth, Germany’s export engine has been underperforming recently. German exports to China are falling by almost 11 percent year-on-year, as the market share for German carmakers decreases. Additionally, German chemical companies are facing challenges due to rising gas prices. Overall, German exports have dropped by over 5% in March compared to the previous month. For all non-EU countries, the decline is even more significant at -5.7% compared to the previous month and -2.0% compared to the same month a year ago.

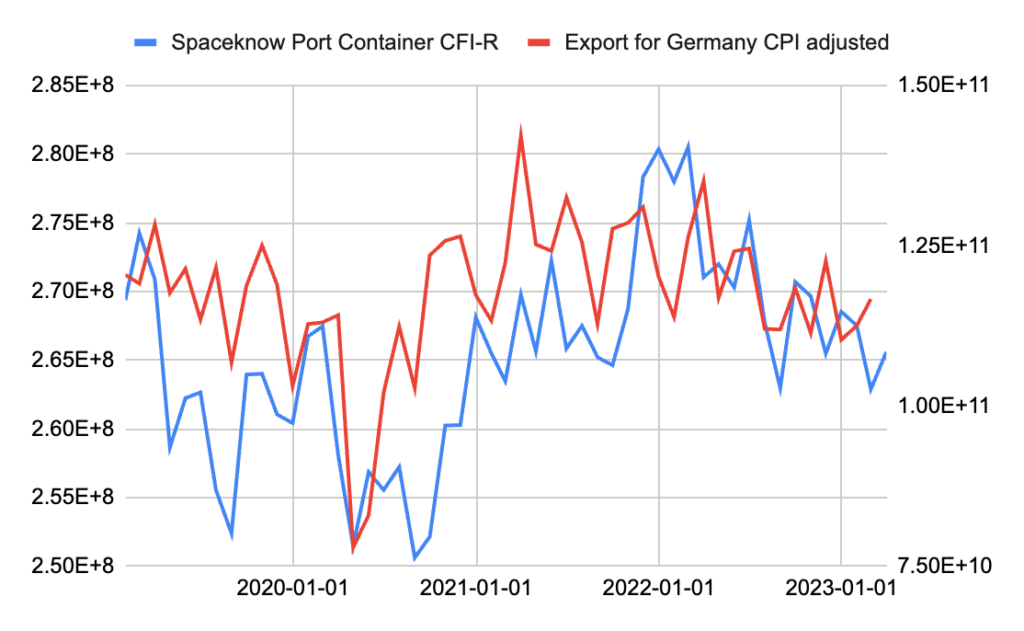

Spaceknow monitors various aspects of the German economy and has developed a range of satellite data-based indices. The product also provides one-step ahead predictions for some benchmarks (using our satellite indices as input). These include measuring various logistic centers and container storage locations in Germany. Our port container index proved to be a valuable tool for investigating exports across multiple countries. Figure 1 graphs the Spaceknow Port Container index versus the value of goods exported from Germany in US dollars. As the index monitors square meters covered by transportation containers in key German ports, it works best with the real values of exports, excluding the effect of rising prices of goods. Figure 1 shows the index can track German exports (especially after Covid) even though a large portion of German goods are transported via road to neighboring countries.

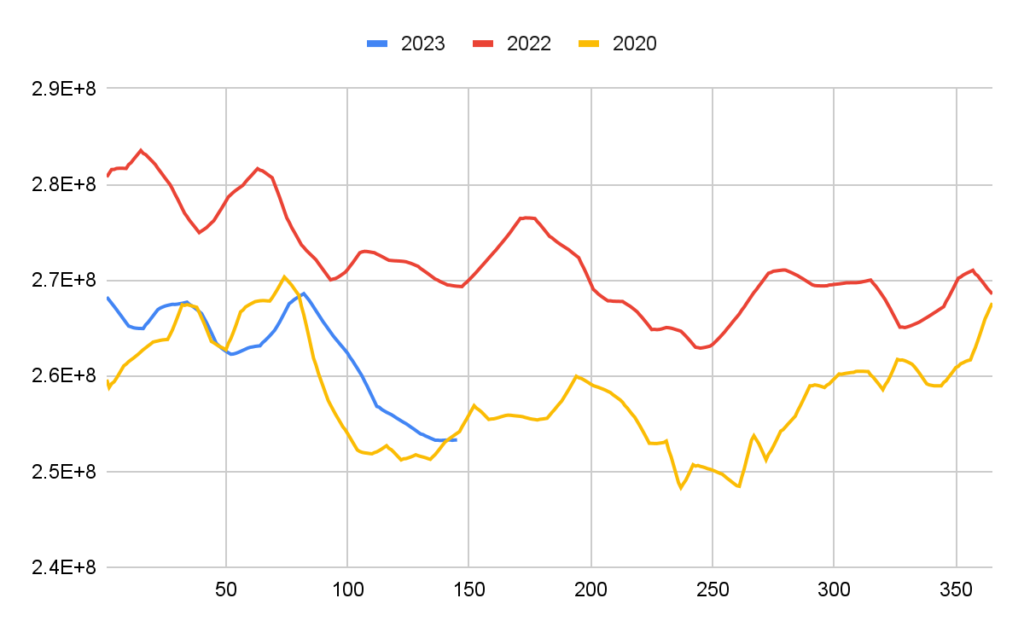

In line with the actual values of German exports, our Port Container index continues to experience a decline on both a monthly and year-on-year basis. Prior to seasonal adjustment, the index recorded a 6 percent drop in April compared to the same period last year, and a 4.1 percent decrease in Q1. These figures indicate a decrease in demand, leading to a decrease in container activity at German ports. Figure 2 below illustrates the development of the Port Container index over several years, highlighting the significant decline in index values for 2023 compared to the previous year, closely resembling the levels observed during the COVID-impacted year of 2020. The blue line representing 2023 suggests that the index reached its lowest point in late May after a prolonged downturn that began in March. Consequently, we anticipate that the May figures for German exports will continue to be disappointing both in month-on-month and year-on-year comparisons. However, we expect the activity to gradually increase once again in June.

Moreover, Germany is facing the challenge of a broader economic downturn caused by persistent inflation and the disruption of Russian gas supplies as a result of the invasion of Ukraine. These factors have contributed to the country’s recession in the first quarter of the year. The economy contracted by 0.3% between January and March, following a 0.5% contraction in the previous quarter. High inflation rates, particularly in April (7.2%), have impacted household spending on items like food or clothing, while industrial orders have weakened due to higher energy prices. Household spending and government spending both decreased, and car sales declined after reductions in government grants for electric and hybrid vehicles. Private sector investment and exports showed some growth but were insufficient to prevent Germany from entering a recession. The German central bank expects modest growth in the second quarter, driven by a rebound in industry. However, the International Monetary Fund (IMF) predicts a 0.1% contraction for Germany this year, making it the weakest among advanced economies.

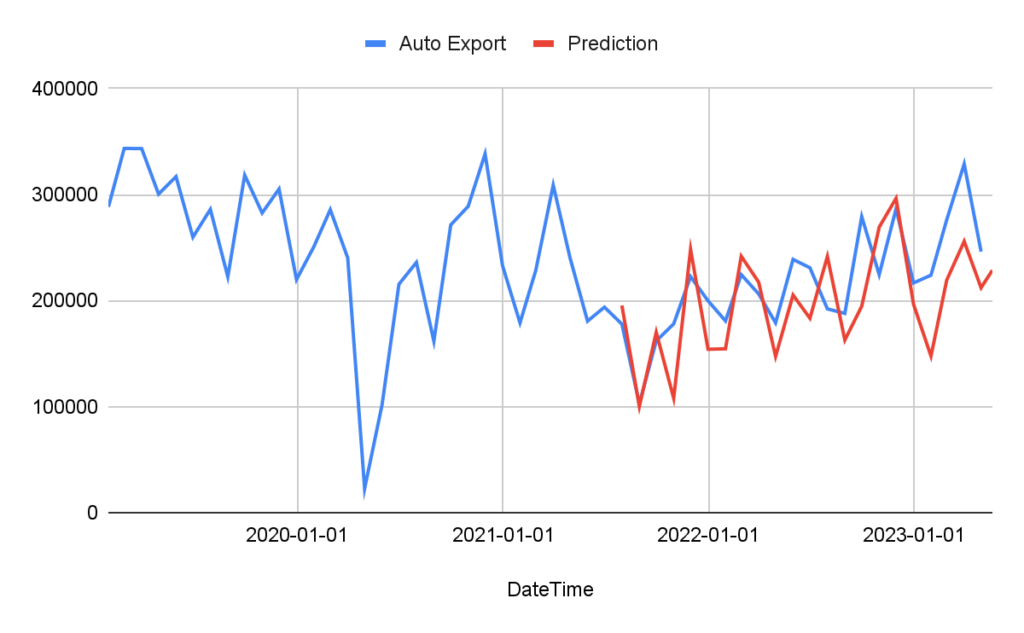

Figure 3 presents Spaceknow’s multi-input supervised index, which has been trained to forecast monthly German Auto Exports. The index utilizes a combination of Spaceknow Nowcasting indices, such as car production, inland logistics centers, and port containers, along with additional indices, to train the model. In Figure 3, we observe an out-of-sample prediction of car export volumes from Germany generated by this model. Notably, the model accurately predicts the recent decline in export activity, demonstrating its effectiveness in forecasting trends. The latest available prediction suggests that the export numbers could start improving again.

As already mentioned, fierce competition in the Chinese market is a key factor contributing to the falling German exports. According to data from Germany’s automobile association VDA, their total market share rose from 19.9% in 2015 to 24.6% in 2019. However, it has since declined, falling back to 19.1%. German car companies strive to maintain their market dominance in the electric age. Chinese consumers are driving the trends that will shape the future of the automotive industry. While German cars were once seen as the pinnacle of global engineering, the shift to the electric age has positioned Chinese counterparts as leaders in EV technology. With a heavy reliance on China for a third of their passenger vehicle sales, German companies have a lot at stake. Moreover, the German government canceled some EV-related subsidies causing a significant decline in new electric vehicle registrations in Germany. In January, registrations for battery electric vehicles dropped by approximately 83%, from 104,300 in December to 18,100. The share of e-cars also decreased from over 55% in December to 15% in January..

The recent data indicates a potential structural shift in the German economy, which could place unexpected pressure on the manufacturing powerhouse. Experts suggest that Germany’s economic struggles are not a temporary setback but may reflect deeper structural weaknesses and a lack of clear solutions to address them. The ongoing war in Ukraine, demographic changes, and the energy transition are expected to have long-term implications for the German economy. Despite some relief from a mild winter and China’s economic recovery, the outlook remains challenging, with Germany likely to continue being a drag on overall economic prospects in the entire eurozone, given its significant role as the bloc’s largest economy and trading partner for many EU countries. Spaceknow continues to monitor diverse aspects of the German economy and has recently created new series and supervised indices to track GDP, including manufacturing output, autos, services, retail sales, trade, new orders, and construction. We expect to launch our comprehensive Global Auto database soon, which will provide detailed coverage of key German automotive brands.

Thank you for reading. Did you find value in this article? Share it with a friend or colleague.

Did you know we also monitor these countries?

Client Support

Each client is assigned an account representative who will reach out periodically to make sure that the data packages are meeting your needs. Here are some other ways to contact SpaceKnow in case you have a specific question.

For delivery questions and issues: Please reach out to support@spaceknow.com

For data questions: Please reach out to info@spaceknow.com

For pricing/sales support: Please reach out to info@spaceknow.com or sales@spaceknow.com

Disclaimer

This report is provided by SpaceKnow, Inc. (“SpaceKnow”) pursuant to the following terms and conditions:

Industry data and reports published by SpaceKnow (“SpaceKnow Reports”) and made available to paid subscribers and/or other recipients (collectively “Recipients”) are creative works of the mind achieved through algorithmic analysis of publicly available data and the information therein is proprietary to SpaceKnow and protected by copyright. Any copying, distribution or reproduction without the prior permission of SpaceKnow is strictly prohibited.

SpaceKnow Reports are confidential and nothing therein may be disclosed, reproduced, transmitted, distributed, sold, licensed, or altered, in whole or in part, without SpaceKnow’s prior written consent. SpaceKnow reserves the right to release to the public at any time the data and reports provided to Recipients. No rights in SpaceKnow Reports or any of the information contained therein are transferred to Recipients. Any misappropriation or misuse of the information in SpaceKnow Reports will cause serious damage to SpaceKnow and money damages may not constitute sufficient compensation to SpaceKnow; consequently, Recipients agree that in the event of any misappropriation or misuse, SpaceKnow shall have the right to obtain injunctive relief in addition to any other legal or financial remedies to which SpaceKnow may be entitled.

SpaceKnow Reports are based only upon its algorithmic analysis of publicly available data and do not use or rely upon any material non-public information (“MNPI”). The insights included in SpaceKnow Reports do not constitute MNPI or inside information and SpaceKnow is not an insider. SpaceKnow Reports (1) may contain opinions based on third party sources that are not independently verified for accuracy or completeness, (2) may contain forward- looking statements, which are identified by words such as “expects,” “anticipates,” “believes,” or “estimates,” and similar expressions, and (3) are current as of the date of publication but may contain information or statements that are subject to change without notice. SpaceKnow has no obligation to, and will not, update any information contained in SpaceKnow Reports. Actual outcomes could differ materially from those anticipated in SpaceKnow Reports. As a result, the use of SpaceKnow Reports is at Recipients’ own risk.

SpaceKnow and its owners, affiliates and representatives are not (1) investment advisers, commodity trading advisers, broker-dealers, financial analysts, financial planners, or banks, (2) compensated for providing investment advice, (3) registered or licensed with any regulatory body in any jurisdiction as investment advisers, commodity trading advisers, financial planners, broker-dealers, or in any other capacity (including, without limitation, the U.S. Securities & Exchange Commission (the “SEC”), the U.S. Commodity Futures Trading Commission (the “CFTC”), the U.S. Financial Regulatory Authority (“FINRA”), or their equivalents in non- U.S. jurisdictions), and do not recommend the sale or purchase of securities or commodity interests, or (4) licensed or able to provide investment advice or respond to individual requests for recommendations to purchase or sell any securities or commodity interests. No regulatory body in any jurisdiction (including the SEC, CFTC, FINRA, or a regulatory body of any state or any non-U.S. jurisdiction) has endorsed SpaceKnow or the contents of SpaceKnow Reports or the accuracy, adequacy, safety, reliability, usefulness, quality or legitimacy of any information provided to subscribers in SpaceKnowReports. SpaceKnow Reports are not intended to constitute investment advice. SpaceKnow is not an investment adviser within the meaning of Section 202(a)(11) of the U.S. Investment Advisers Act of 1940, as amended, and is not a commodity trading adviser within the meaning of Section 1(a)(12) of the U.S. Commodity Exchange Act. SpaceKnow does not provide investment advisory, portfolio management or financial planning services. The analyses, forecasts, metrics, samples, estimated figures, trends, figures, tables, graphs, projections and other forms of data that may be contained in SpaceKnow Reports do not represent or contain any recommendations to buy or sell any security or any financial products and should not be relied upon as the basis for any transactions in securities.

SpaceKnow Reports are for informational, promotional, educational or evaluation purposes only. Any information contained in SpaceKnow Reports constitutes the opinion or forward-looking statement of individuals and is provided without any representation or warranty of any kind. Neither SpaceKnow nor its directors, officers, employees, agents or representatives shall have any responsibility to you or any third party for the accuracy or completeness of any information provided in any SpaceKnow Report.

Should you have any questions, please contact us at SKNowcastingSolutions@spaceknow.com.