Summary

Leading indicators show a mix of optimistic growth potential and cautious recessionary signals. Unsupervised and supervised satellite activity indices provide predictive insights for the economies of the U.S., Germany, and China.

In more detail

After widespread fears of recession throughout 2022 and early 2023, recent developments have brought positive news for the US economy. The fight with inflation is not over yet – after very positive June inflation numbers, US inflation rebounded to 3.2% annually in July.

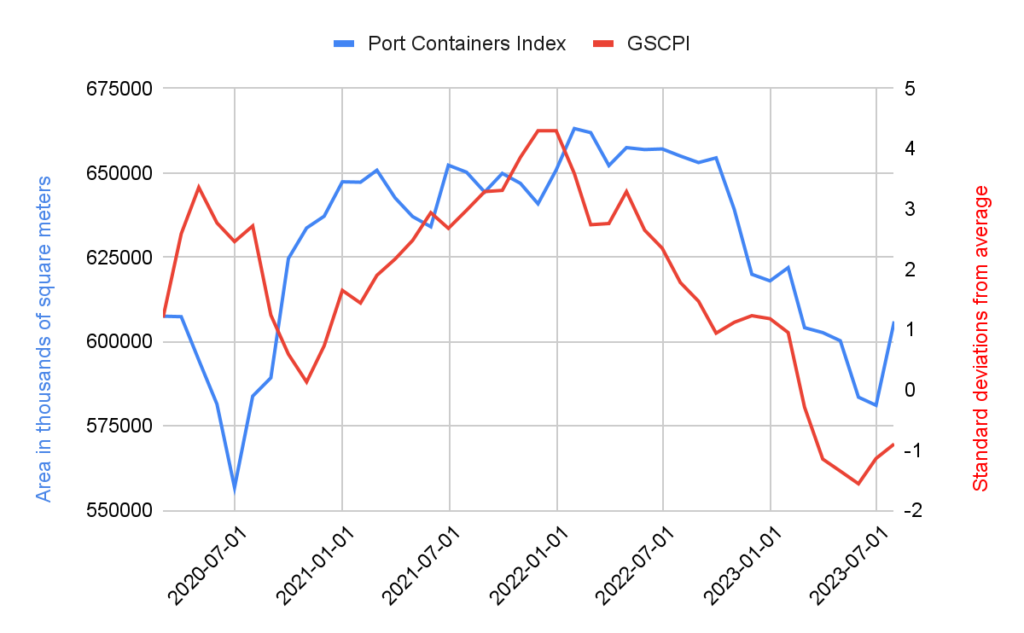

Spaceknow’s contribution to monitoring inflation is focused mainly on the supply side of the economy – the inflation surge has been strongly connected to the supply chain disruption and the economy’s reaction to it. Spaceknow indices are uniquely built to monitor industrial activity and supply chain stress – Figure 1 below shows the US Port Container Index matching the Global Supply Chain Pressure Index well despite monitoring only key US ports.

Positive atmosphere in the US is not shared universally, the current economic situation in Germany presents a stark contrast to its previous status as an economic superstar. The German economy, once hailed for its robustness, is now facing significant challenges. The recent decline in economic output over two consecutive quarters has plunged Germany into what economists term a “technical recession.” Notably, the country’s industrial sector, long celebrated as a cornerstone of its economy, is underperforming – it fell 1.5% between May and June and 1.69% annually. The country’s key automotive sector fell even more by 3.5%. Industries heavily reliant on exports, such as engineering and automotive, are grappling with decreased demand from foreign markets.

The industry is still relatively busy thanks to the accumulation of COVID backlogs. While in the past concerns have been raised due to a decline in a key leading indicator, factory new orders – showing a significant decline between March and May. However, the most recent data shows a much rosier picture with the factory’s new orders defying expectations by 7%, showing the biggest increase in three years.

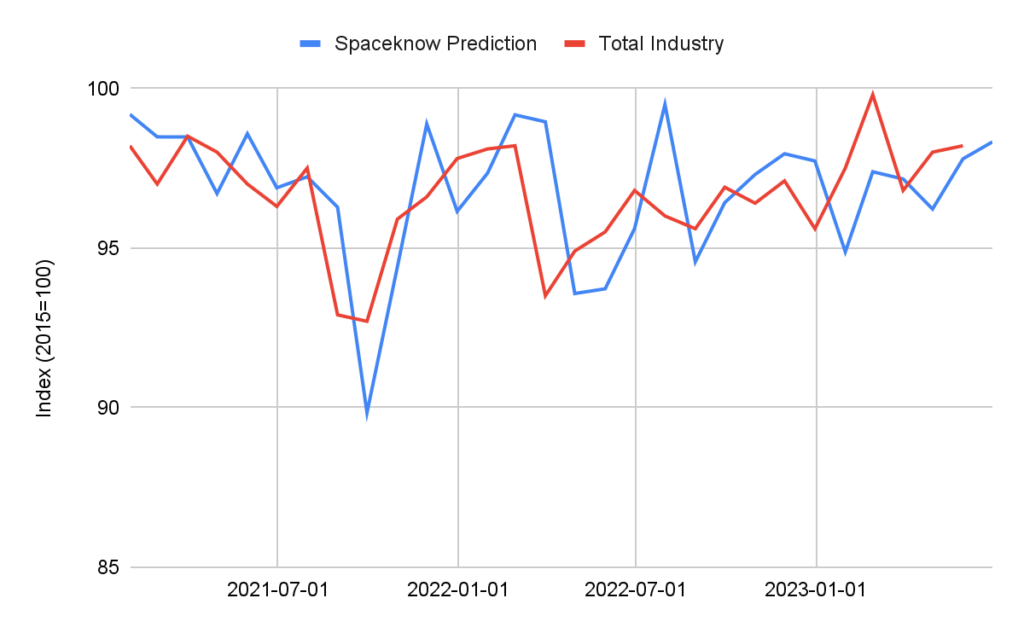

Spaceknow offers its clients predictions of key economic indicators in Germany using Spaceknow’s Supervised indices. Inputs into these models are SpaceKnow’s unsupervised indices which give unbiased insights into real-world physical activity across diverse sectors and industries. The supervised indices are then used as inputs in Gaussian Process Regression, a powerful and versatile tool for various applications in machine learning and statistical analysis, to achieve predictions of key macroeconomic variables and to evaluate which of the sectoral Spaceknow indices are the most important for predicting macroeconomic aggregates. The indices are designed to give one-step-ahead predictions of the official macroeconomic and key sectoral statistics (such as those presented below), effectively providing reliable nowcasting estimates weeks before the official data is released.

Figure 2 shows another measure that allows for cautious optimism in the German economy. Total industrial output without construction predicted using Spaceknow sectoral indices, our Inland container index, car index together with the metal indices (copper above all) played the biggest role in our prediction. For June 2023 we predict 98.3 a moderate increase from last month, this again shows a certain sign of relief for the German economy as the industrial output is predicted to grow. For now, it is unclear whether these numbers are only a temporary respite or a sign that the eurozone’s largest economy could rebound from its recent troubles without painful reforms.

China’s economy created a lot of negative news recently. It entered a period of deflation, underscoring its struggle to meet recovery expectations following prolonged Covid-related lockdowns. However, experts indicate that this deflationary trend is likely temporary and poses minimal risk beyond China’s borders. Unlike pervasive deflation that arises from consumers refraining from buying due to financial distress, China’s case is distinct, with its economy still growing and output could still expand by nearly 5% this year.

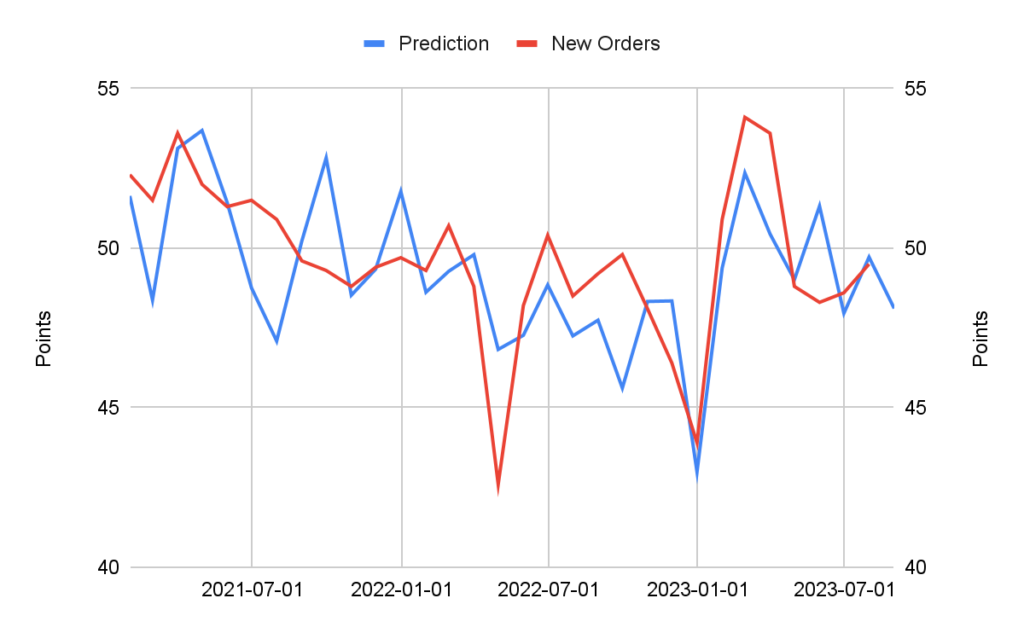

Spaceknow provides predictions of the producer price index (PPP) for China. We estimate PPI to stay relatively flat at 107.9 for August 2023, this means almost zero change from the previous period and suggests that the deflation could be relatively short-lived. Moreover, Figure 3 shows SpaceKnow prediction of the New Orders in China – similarly to Germany this metric also showed some positive momentum, so far we predict a reversal in this trend for August.

| Metric | Germany | China |

| New Orders | 4.7% | -3.1% |

| Manufacturing (Industry) | 0.5% | 1.8% |

| Car Production | -12% | 9% |

The table above shows the percentage change in selected comparable metrics for China and Germany between the last available value for the given benchmark and Spaceknow prediction for the following month. This indicates if we expect the variable to grow or fall in August/July/June. As can be seen from the table, results are mixed with some of the variables clearly suggesting optimism and growth while others pointing in a definite recessionary direction.

As presented above, SpaceKnow’s indices offer valuable insights into global economic trends, providing a unique focus on supply chain disruptions, industrial activity, and sectoral performance. By leveraging both unsupervised and supervised indices, SpaceKnow enables clients to make informed decisions with reliable nowcasting estimates weeks ahead of official data releases. These indices not only contribute to monitoring inflation but also offer predictive power for key economic indicators in various regions, such as seen with the examples of Germany and China. Amid economic uncertainties, SpaceKnow’s data-driven approach helps businesses navigate the ever-changing landscape with a mix of optimistic growth potential and cautious recessionary signals.

Thank you for reading.

Did you find value in this article? Share it with a friend or colleague.

The upcoming release of the “Global Automotive Dataset” by SpaceKnow is the company’s most extensive satellite activity data release to date. Monitoring 100+ car, bus, truck, tire, and semiconductor (auto-focused) companies globally.

Reach out to the sales team to learn more about this new dataset

Client Support

Each client is assigned an account representative who will reach out periodically to make sure that the data packages are meeting your needs. Here are some other ways to contact SpaceKnow in case you have a specific question.

For delivery questions and issues:

Please reach out to support@spaceknow.com

For data questions:

Please reach out to info@spaceknow.com

For pricing/sales support:

Please reach out to info@spaceknow.com or sales@spaceknow.com

Disclaimer

This report is provided by SpaceKnow, Inc. (“SpaceKnow”) pursuant to the following terms and conditions:

Industry data and reports published by SpaceKnow (“SpaceKnow Reports”) and made available to paid subscribers and/or other recipients (collectively “Recipients”) are creative works of the mind achieved through algorithmic analysis of publicly available data and the information therein is proprietary to SpaceKnow and protected by copyright. Any copying, distribution or reproduction without the prior permission of SpaceKnow is strictly prohibited.

SpaceKnow Reports are confidential and nothing therein may be disclosed, reproduced, transmitted, distributed, sold, licensed, or altered, in whole or in part, without SpaceKnow’s prior written consent. SpaceKnow reserves the right to release to the public at any time the data and reports provided to Recipients. No rights in SpaceKnow Reports or any of the information contained therein are transferred to Recipients. Any misappropriation or misuse of the information in SpaceKnow Reports will cause serious damage to SpaceKnow and money damages may not constitute sufficient compensation to SpaceKnow; consequently, Recipients agree that in the event of any misappropriation or misuse, SpaceKnow shall have the right to obtain injunctive relief in addition to any other legal or financial remedies to which SpaceKnow may be entitled.

SpaceKnow Reports are based only upon its algorithmic analysis of publicly available data and do not use or rely upon any material non-public information (“MNPI”). The insights included in SpaceKnow Reports do not constitute MNPI or inside information and SpaceKnow is not an insider. SpaceKnow Reports (1) may contain opinions based on third party sources that are not independently verified for accuracy or completeness, (2) may contain forward- looking statements, which are identified by words such as “expects,” “anticipates,” “believes,” or “estimates,” and similar expressions, and (3) are current as of the date of publication but may contain information or statements that are subject to change without notice. SpaceKnow has no obligation to, and will not, update any information contained in SpaceKnow Reports. Actual outcomes could differ materially from those anticipated in SpaceKnow Reports. As a result, the use of SpaceKnow Reports is at Recipients’ own risk.

SpaceKnow and its owners, affiliates and representatives are not (1) investment advisers, commodity trading advisers, broker-dealers, financial analysts, financial planners, or banks, (2) compensated for providing investment advice, (3) registered or licensed with any regulatory body in any jurisdiction as investment advisers, commodity trading advisers, financial planners, broker-dealers, or in any other capacity (including, without limitation, the U.S. Securities & Exchange Commission (the “SEC”), the U.S. Commodity Futures Trading Commission (the “CFTC”), the U.S. Financial Regulatory Authority (“FINRA”), or their equivalents in non- U.S. jurisdictions), and do not recommend the sale or purchase of securities or commodity interests, or (4) licensed or able to provide investment advice or respond to individual requests for recommendations to purchase or sell any securities or commodity interests. No regulatory body in any jurisdiction (including the SEC, CFTC, FINRA, or a regulatory body of any state or any non-U.S. jurisdiction) has endorsed SpaceKnow or the contents of SpaceKnow Reports or the accuracy, adequacy, safety, reliability, usefulness, quality or legitimacy of any information provided to subscribers in SpaceKnowReports. SpaceKnow Reports are not intended to constitute investment advice. SpaceKnow is not an investment adviser within the meaning of Section 202(a)(11) of the U.S. Investment Advisers Act of 1940, as amended, and is not a commodity trading adviser within the meaning of Section 1(a)(12) of the U.S. Commodity Exchange Act. SpaceKnow does not provide investment advisory, portfolio management or financial planning services. The analyses, forecasts, metrics, samples, estimated figures, trends, figures, tables, graphs, projections and other forms of data that may be contained in SpaceKnow Reports do not represent or contain any recommendations to buy or sell any security or any financial products and should not be relied upon as the basis for any transactions in securities.

SpaceKnow Reports are for informational, promotional, educational or evaluation purposes only. Any information contained in SpaceKnow Reports constitutes the opinion or forward-looking statement of individuals and is provided without any representation or warranty of any kind. Neither SpaceKnow nor its directors, officers, employees, agents or representatives shall have any responsibility to you or any third party for the accuracy or completeness of any information provided in any SpaceKnow Report.

Should you have any questions, please contact us at SKNowcastingSolutions@spaceknow.com.