Summary:

SpaceKnow France Nowcasting Insights help our customers track economic growth in important sectors like consumer spending, housing, and exports.

More details:

France and the rest of the European countries have experienced challenging times since 2022. The initial COVID blow affected the country through lockdowns, put pressure on public finances, and derailed many businesses. Later, the Russian invasion of Ukraine hit France with the rest of Europe, bringing unprecedented turmoil in the energy markets. The country has had inflationary pressure like most world economies. Recently, France experienced massive strikes related to a proposed pension reform.

Spaceknow has a family of indices based on satellite imagery, specifically Synthetic Aperture Radar (SAR) measurements, monitoring the French economy. These indices can help you track some of the important elements described above. Below, we showcase three of our indices, that help to understand the development of the French economy.

Construction and Housing Sector:

Figure 1 graphs SpaceKnow France Cement Storages SAI in comparison to new housing unit starts in France on a monthly basis. We believe the index can help predict French housing sector peaks and measure the general trend. Similar to our cement indices for the US, the index lows do not fully match the industry’s seasonality. This is likely due to inventory management in the industry – our indices are capturing the behavior of industry response as their order books change. Our indices also capture changes in the business cycle. If demand for new housing decreases, cement storage can start filling up.

The fluctuations dominating Figure 1 are mainly seasonal. Figure 2 shows our Cement Storages SAI and Housing starts with the seasonal component removed to show a long-term relationship between the series. We can see that the index shares the same trend with France’s housing starts, apart from a relatively short period that largely coincides with the COVID crisis in France. In this period, construction activity was muted, causing storage to fill.

Retail sector:

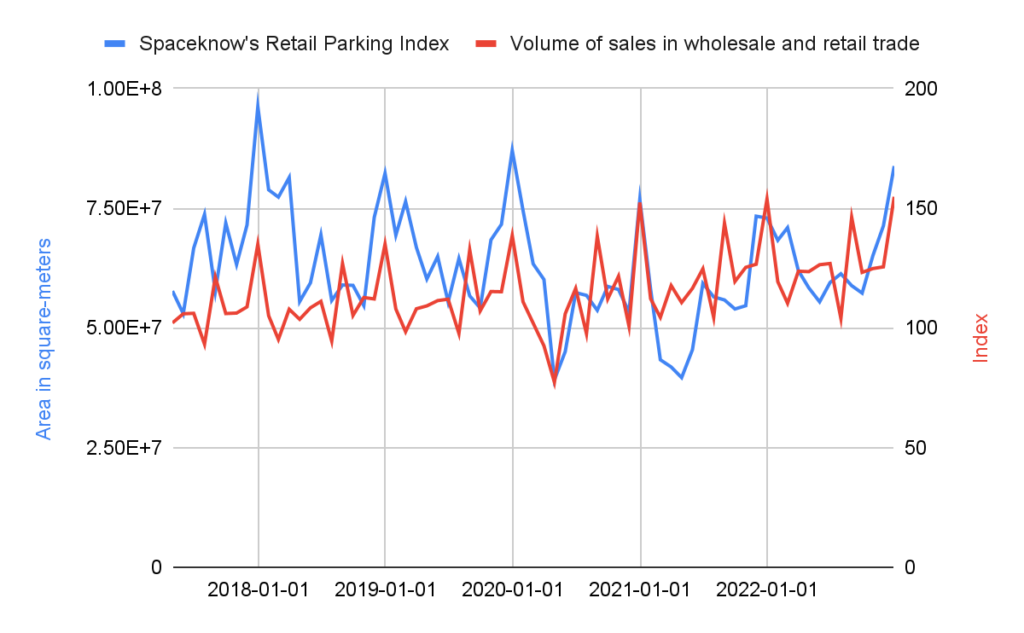

COVID and the recent weakness of the global economy significantly impacted the retail sector. Figure 3 shows the Spaceknow France Retail SAI, which observes the area covered by cars in major shopping centers. Despite the steady rise of e-commerce, physical shopping plays an important role. Figure 3 compares this index with the volume of sales in the French retail sector. We can see the French retail sector’s strong end-of-the-year performance, with the sales volume and Spaceknow index surpassing last year’s result.

Trade Sector:

Spaceknow observes the major French ports and inland logistic hubs. As Figure 4 shows, this allows us to track the trend of French goods exports. While the trade balance in many European countries is heavily influenced by energy imports which can be hard to track via SAR indices, Spaceknow indices are well suited to monitor goods exports. We see that both goods exports (in euros) and the Spaceknow France Port Container SAI (measuring the volume of goods) have been on an increasing trend since the start of the pandemic. As France’s inflation is still relatively low, we see no significant divergence between the Spaceknow index and the value of exports.

Our indices provide context to the underlying growth, policy, and inflation issues in the French economy.

A quick recap of the situation in France so far:

Despite the challenges posed in 2022, the French economy was surprisingly resilient. Thanks to the end of COVID measures revitalizing the service sector in combination with government policies, France achieved annual GDP growth of 2.6%. This is a surprisingly vibrant outcome, especially compared to Germany and the UK. Inflation in France averaged 5.2%, while many of its European neighbors exceeded double-digit inflation. Other good news came from the labor market with the lowest reported number of unemployed since 2011, and the CAC index reached an all-time high recently.

The near future, however, may not be so bright. France is expected to see very high levels of inflation in the first quarter of 2023 – led by increases in energy bills (which were limited by government policy to 4% in 2022) but will be accompanied by a further increase of 15% in 2023, hitting household bills hard. This will result in a record loss for the state-owned energy giant EDF.

Moreover, forecasters expect the economy to slow down and the government forecast of 1% year-on-year growth will be hard to achieve. The reasons are the weakening purchasing power of French households, economic uncertainty, and weak global demand for French manufacturing products. Growth may also be affected by the series of strikes related to pension reform.

France appeared prominently in the international news due to public pushback on its proposed pension reform planning to increase the minimum retirement age from 62 to 64. This reform was meant to prevent the pension system from collapsing due to demographic pressures but it was met with a huge wave of protests. The macroeconomic impact of the protests will likely depend on the length and intensity of the strikes, but past experiences suggest it could cost up to 0.2 percent of GDP.

We will continue to monitor the country’s economic activity in near-real time using our satellite activity indices.

Thank you for reading. Did you find this article interesting? Share it with a friend or colleague.

Disclaimer

This report is provided by SpaceKnow, Inc. (“SpaceKnow”) pursuant to the following terms and conditions:

Industry data and reports published by SpaceKnow (“SpaceKnow Reports”) and made available to paid subscribers and/or other recipients (collectively “Recipients”) are creative works of the mind achieved through algorithmic analysis of publicly available data and the information therein is proprietary to SpaceKnow and protected by copyright. Any copying, distribution or reproduction without the prior permission of SpaceKnow is strictly prohibited.

SpaceKnow Reports are confidential and nothing therein may be disclosed, reproduced, transmitted, distributed, sold, licensed, or altered, in whole or in part, without SpaceKnow’s prior written consent. SpaceKnow reserves the right to release to the public at any time the data and reports provided to Recipients. No rights in SpaceKnow Reports or any of the information contained therein are transferred to Recipients. Any misappropriation or misuse of the information in SpaceKnow Reports will cause serious damage to SpaceKnow and money damages may not constitute sufficient compensation to SpaceKnow; consequently, Recipients agree that in the event of any misappropriation or misuse, SpaceKnow shall have the right to obtain injunctive relief in addition to any other legal or financial remedies to which SpaceKnow may be entitled.

SpaceKnow Reports are based only upon its algorithmic analysis of publicly available data and do not use or rely upon any material non-public information (“MNPI”). The insights included in SpaceKnow Reports do not constitute MNPI or inside information and SpaceKnow is not an insider. SpaceKnow Reports (1) may contain opinions based on third party sources that are not independently verified for accuracy or completeness, (2) may contain forward- looking statements, which are identified by words such as “expects,” “anticipates,” “believes,” or “estimates,” and similar expressions, and (3) are current as of the date of publication but may contain information or statements that are subject to change without notice. SpaceKnow has no obligation to, and will not, update any information contained in SpaceKnow Reports. Actual outcomes could differ materially from those anticipated in SpaceKnow Reports. As a result, the use of SpaceKnow Reports is at Recipients’ own risk.

SpaceKnow and its owners, affiliates and representatives are not (1) investment advisers, commodity trading advisers, broker-dealers, financial analysts, financial planners, or banks, (2) compensated for providing investment advice, (3) registered or licensed with any regulatory body in any jurisdiction as investment advisers, commodity trading advisers, financial planners, broker-dealers, or in any other capacity (including, without limitation, the U.S. Securities & Exchange Commission (the “SEC”), the U.S. Commodity Futures Trading Commission (the “CFTC”), the U.S. Financial Regulatory Authority (“FINRA”), or their equivalents in non- U.S. jurisdictions), and do not recommend the sale or purchase of securities or commodity interests, or (4) licensed or able to provide investment advice or respond to individual requests for recommendations to purchase or sell any securities or commodity interests. No regulatory body in any jurisdiction (including the SEC, CFTC, FINRA, or a regulatory body of any state or any non-U.S. jurisdiction) has endorsed SpaceKnow or the contents of SpaceKnow Reports or the accuracy, adequacy, safety, reliability, usefulness, quality or legitimacy of any information provided to subscribers in SpaceKnowReports. SpaceKnow Reports are not intended to constitute investment advice. SpaceKnow is not an investment adviser within the meaning of Section 202(a)(11) of the U.S. Investment Advisers Act of 1940, as amended, and is not a commodity trading adviser within the meaning of Section 1(a)(12) of the U.S. Commodity Exchange Act. SpaceKnow does not provide investment advisory, portfolio management or financial planning services. The analyses, forecasts, metrics, samples, estimated figures, trends, figures, tables, graphs, projections and other forms of data that may be contained in SpaceKnow Reports do not represent or contain any recommendations to buy or sell any security or any financial products and should not be relied upon as the basis for any transactions in securities.

SpaceKnow Reports are for informational, promotional, educational or evaluation purposes only. Any information contained in SpaceKnow Reports constitutes the opinion or forward-looking statement of individuals and is provided without any representation or warranty of any kind. Neither SpaceKnow nor its directors, officers, employees, agents or representatives shall have any responsibility to you or any third party for the accuracy or completeness of any information provided in any SpaceKnow Report.

Should you have any questions, please contact us at SKNowcastingSolutions@spaceknow.com.